Life Insurance Facts

Australians and Life Insurance

One of the most unfortunate facts about life insurance is that very few Australians have enough.

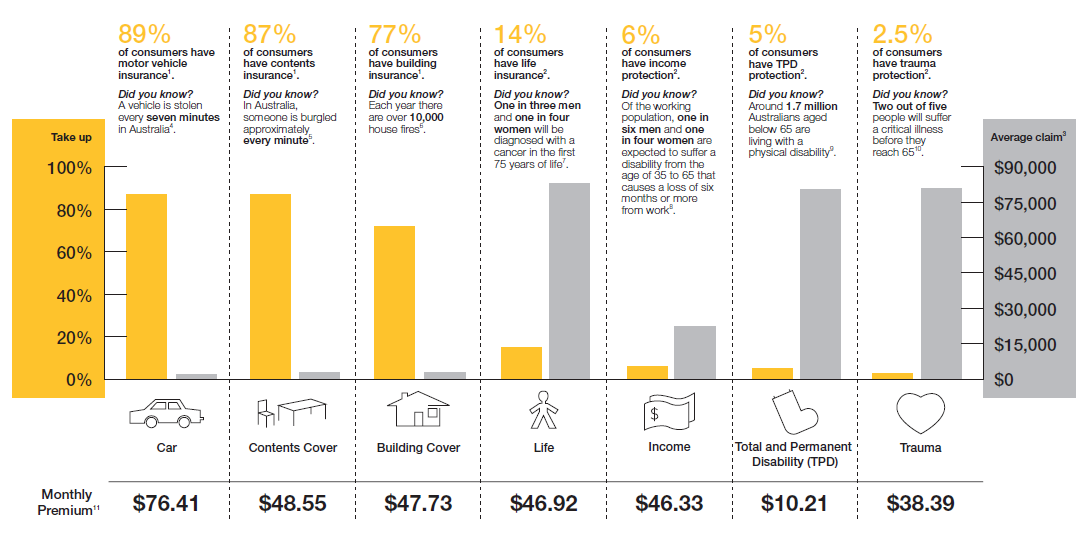

Of the world’s developed nations, Australia ranks as one of the lowest when it comes to Life Insurance cover.1 In fact, only 5% of Australians have adequate life insurance.2 As can be seen in the following infographic, this is in stark contrast to the number of Australians who insure the cars, houses and contents.

Why is it that Australians take such a nonchalant attitude to Life Insurance? Some claim it is due to cost, but as can be seen in the graphic above, life insurance costs are not overly different to the cost of insuring your car or home; especially when you consider the much larger average benefit payments that are made.

After years of helping our clients improve their financial protection, we have concluded there are two primary reasons Australian’s don’t have sufficient life insurance:

- They are not sure how much life insurance they need or how to go about getting it

- They subconsciously believe (or perhaps hope) “It won’t happen to me”

Through our innovative Life Insurance Calculator and Life Insurance Application tools we believe we’ve gone a long way to solving the first reason.

If you thought hard enough, you’d probably surprise yourself at the number of people you know who have been directly impacted by the unexpected death, accident or illness of a loved one. However, in an attempt to demonstrate more clearly just how likely it is that you’ll be impacted by an insurable event, we’ve compiled this page of statistics.

More information about the different types of insurance can be found on our Life Insurance FAQ page

Life and Disability Insurance Statistics

- One in five families will be impacted by the death of a parent, a serious accident or illness that renders a parent unable to work;2

- 60% of families with dependants will run out of money within 12 months if the main income earner dies10

- For Australian families with children under the age of 5, the median amount of debt is $167,0008

- The average life insurance payout is $91k9

Income Protection

- Over a working lifetime of 40 years, the average Australian earns around $3,000,00011

- 1 in 3 people of working age will suffer an accident or a serious illness that will keep them off work for more than 3 months5

Trauma Insurance Statistics

- Women are five times more likely to make a trauma insurance claim than a life insurance claim3

- 1 in 2 men and 1 in 3 women will be diagnosed with cancer before the age of 8512

- Five year survival from all cancers combined increased from 47% in 1982 – 1987 to 66% in 2006 – 20104

- One in six Australians are affected by cardio vascular disease

- Nearly 1,000,000 Australians are currently diagnosed with diabetes

Life Insurance Companies Claims

Sources

- Swiss Re Economic Research & Consulting , 2007

- Lifewise/NATSEM Underinsurance Report, 2010

- MLC Insurance Claims Statistics

- Australian Institute of Health and Welfare (AIHW)

- Australian, Institute of Actuaries of Australia 2000. Interim Report of the Disability Committee

- www.heartfoundation.org.au – Data and Statistics

- www.diabetesaustralia.com.au – Understanding Diabetes

- ABS – National Income, Expenditure and Product, Dec 2008

- IFSA 2008

- TNS Research – Underinsurance Report – 2005

- ABS – average weekly earnings for full time employees – May 2012

- Australian Cancer Council

Insurance Council of Australia, Consumer Tracking Survey, January 2006